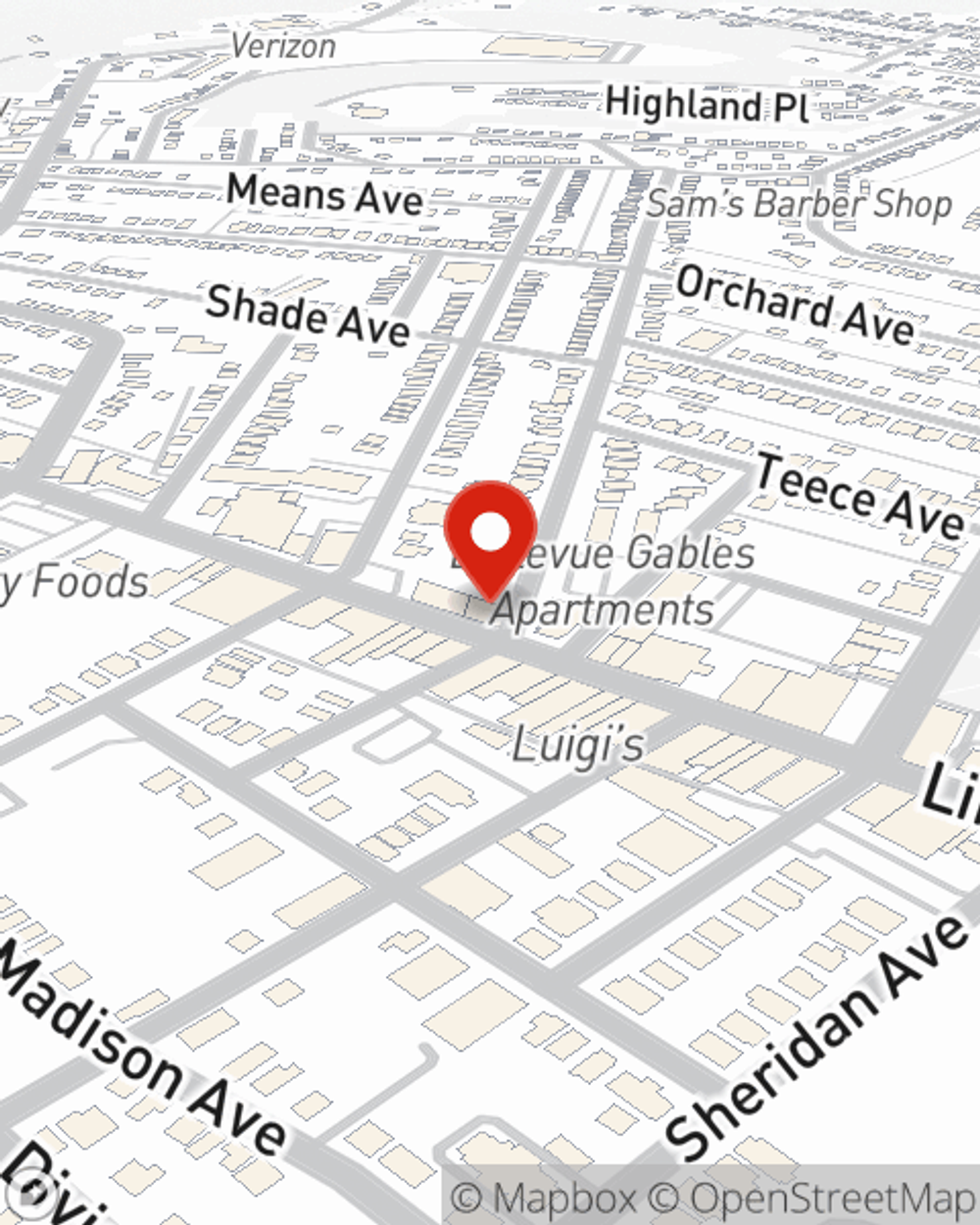

Condo Insurance in and around Bellevue

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

There’s No Place Like Home

As with anything in life, it is a good idea to expect the unexpected and strive to prepare accordingly. When owning a condo, the unexpected could look like damage to your most personal possessions from theft fire, weight of snow, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Protect Your Home Sweet Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance protects more than your condo's structure. It protects both your condo and your valuable possessions. If your condo is affected by falling trees or vandalism, you could have damage to the items inside your condo in addition to damage to the structure itself. Without adequate coverage, you might not be able to replace your valuables. Some of your belongings can be insured against damage or theft even beyond the walls of your condo. If your car is stolen with your computer inside it, a condo insurance policy might come in very handy.

As one of the top providers of condo unitowners insurance, State Farm has you covered. Visit agent Anthony Cecchini today for help getting started.

Have More Questions About Condo Unitowners Insurance?

Call Anthony at (412) 766-5500 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Anthony Cecchini

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.